Business

View All8 Business Web Development Secrets Everybody Ought To Know

February 23, 2018Avoid excessive extras Do not use extras for example page counters, blinking or flashing text and unneeded music. Page counters...

Make Certain You Utilize Unsecured Loans Wisely

February 21, 2018Obtaining the Best Personal Bank Loan Rate Of Interest

February 13, 2018Safety and health Training Advice

February 11, 2018Invesrment

View AllStrong Strategic Business Plan Can assist you to Get Business Investors

September 2, 2017Should you aspire to become effective entrepreneur by launching your personal Startup Venture, you'll want additional ordinary business skills, thorough...

Buying Dallas Property is a superb Investment

November 14, 2016Are you currently a genuine estate investor searching for your forthcoming great...

Beginning Your Online Business

October 14, 2016An online business is a terrific way to supplement your earnings. Consider...

Management

View All

The Many Benefits of Teaching Effective HR Management

August 9, 2017A long-running stage show that wins acclaim and fame the country over....

The 4 Roles Running A Business Management

November 1, 2016

Business Management Essentials

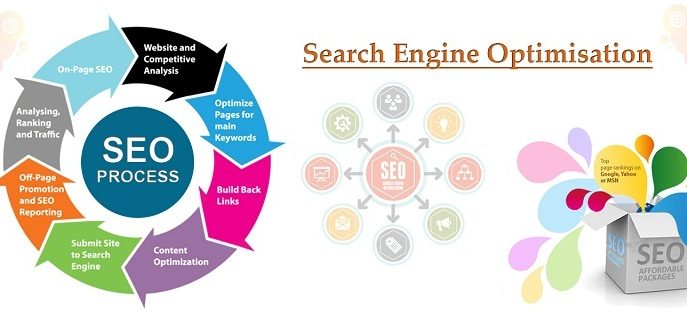

October 14, 2016Marketing

View All

Steps in Small Company Marketing

November 14, 2016There's a couple of fundamental rules you have to follow if you...

Internet Business Marketing Success Tips

October 17, 2016

Home Based Business Marketing Done Affordably

October 14, 2016What exactly is it by pointing out online homework help and tutoring?

May 5, 2017Only somewhat figures of psychology answers help and mentoring locales exist that provide sufficient responses to altered subject enquiries by...

How you can Promote Your Business Online With Free Streaming

October 20, 2016

The Very Best Investment of the Existence

October 14, 2016

The benefits of Foreign exchange Expert Advisory Services

October 12, 2016